MIP to Stay Under EU, New Zealand FTAs, But Apple Growers Fear Margin Erosion

Shimla/New Delhi:

Amid growing anxiety among apple growers in Himachal Pradesh, Jammu & Kashmir, Uttarakhand and the Northeast, senior government officials have sought to reassure that the Minimum Import Price (MIP) regime will continue even after the proposed India-EU and India-New Zealand Free Trade Agreements (FTAs) come into force.

Citing official data. sources told HimbuMail that both price and quantity safeguards have been “carefully designed” to prevent imported apples from destabilising domestic markets. They maintained there would be “no dilution of farmer protection” under the trade pacts.

Rajya Sabha MP from Himachal Pradesh Harsh Mahajan, who raised the issue of apple imports in Parliament, said the Centre has categorically assured protection to domestic growers. Quoting the official reply received in the House, Mahajan said apple farmers’ interests would continue to be safeguarded through the MIP mechanism.

He said the Centre has also made it clear that it retains the right to regulate imports based on the apple season in Himachal Pradesh and other producing states. “Imports will not be permitted in a manner that hurts growers during the peak harvesting season,” Mahajan said, adding that seasonal considerations and price safeguards remain central to government policy.

Importantly, he clarified that quota-based imports under FTAs will not override MIP norms.

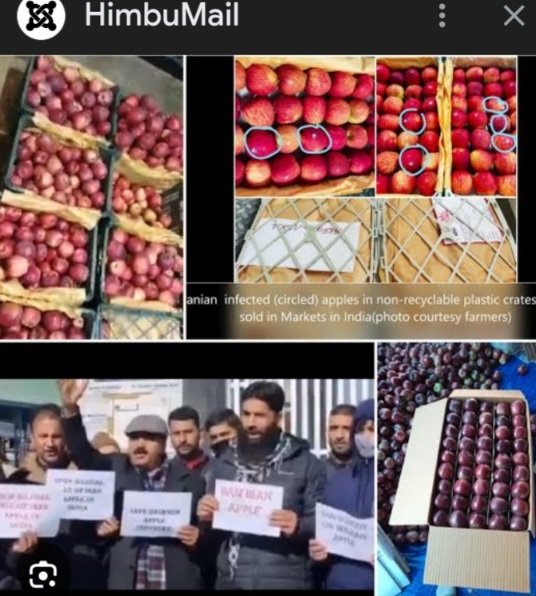

Apple growers have flagged another major concern under the free trade regime, arguing that government assurances often collapse on the ground once import windows open. Farmers say that importers enjoy wide discretion and can bring in fruit whenever they perceive a “right deal”, with little real-time restraint.

“In a free trade regime, there are hardly any effective curbs on importers. They chase maximum profits in lean domestic markets and flood apples when prices are favourable,” growers said.

They questioned what concrete safeguards exist to prevent such market manipulation, asking whether the government has any mechanism to regulate timing, volume and trader behaviour beyond paper assurances.

For apples imported from the European Union, a higher MIP of ₹80 per kg will apply, compared to the current ₹50 per kg. After applying the concessional 20 per cent customs duty, the minimum landed price will work out to around ₹96 per kg.

Officials citing data from the Ministry of Commerce said this price floor is well above the range of low-cost imports currently entering India. Apples from non-FTA countries will continue to face an MIP of ₹50 per kg, with post-duty prices averaging around ₹75 per kg, making EU apples significantly costlier in the domestic market.

India’s market access offer to the EU, officials stressed, has been “calibrated with caution”. Under the agreement, India has offered a Tariff Rate Quota (TRQ) of 50,000 tonnes at the time of entry into force — lower than the current import level of 56,717 tonnes from EU-27 countries in 2024.

The quota will expand gradually to 1 lakh tonnes over a long transition period of 10 years, even as a 20 per cent customs duty continues to apply. “This phased approach ensures domestic producers are not exposed to sudden import shocks,” an official said.

Data, however, shows India’s rising dependence on apple imports. Imports increased from 3.77 lakh metric tonnes in 2020-21 to 5.58 lakh MT in 2024-25. During the same period, imports as a share of domestic production rose from 16.4 per cent to 21.9 per cent.

In 2024-25, India produced 25.5 lakh MT of apples, while imports stood at 5.57 lakh MT, making India the world’s third-largest apple importer. Officials argue that “volume alone does not determine market impact — price does”.

Country-wise data supports this claim. In 2024, India’s largest suppliers were Iran (1.33 lakh tonnes, 25.7%), Türkiye (1.16 lakh tonnes, 22.5%) and Afghanistan (42,716 tonnes, 8.2%). The EU accounted for about 11.3 per cent of imports, mainly from Poland and Italy.

One immediate saving grace for domestic growers is that India has barred apple imports from Türkiye in the aftermath of Operation Sindoor. Türkiye had emerged as one of India’s largest suppliers, accounting for around 22.5 per cent of total apple imports in 2024.

However, the continuation of this restriction remains uncertain, as the Ministry of Commerce has so far not issued any formal clarification on its long-term position vis-à-vis Turkish apples. Growers warn that any rollback could sharply alter market dynamics, given Türkiye’s significant share and competitive pricing.

Landed price trends also show a clear differentiation. In 2025-26 (up to October), apples from Afghanistan averaged ₹77 per kg and Iran ₹79 per kg — the cheapest imports. By contrast, EU apples were far costlier, with Poland averaging ₹101 per kg and Italy ₹114 per kg. Imports from Chile (₹122/kg), New Zealand (₹119/kg) and the US (₹118/kg) were priced even higher.

Officials said these apples reflect higher CIF values and existing duties and therefore do not directly compete with most domestic produce.

Apple growers, however, remain unconvinced. They argue that even higher-priced imports squeeze margins in an already stressed sector. Rising input costs, increasing labour expenses, declining productivity, frequent weather shocks and climate-induced quality loss have severely weakened growers’ competitiveness.

Farmers point out that unlike foreign producers, Indian apple growers receive no Minimum Support Price (MSP), no assured procurement and limited post-harvest support from either the Centre or the states. “Even with MIP, imported apples influence market sentiment and trader pricing, cutting into our profits,” growers warn.

On fears of EU apples flooding Indian markets, officials were categorical. “Any incremental imports under the EU TRQ are expected to substitute low-quality, low-priced apples from other origins, not displace domestic apples from hill states,” an official said.

Officials also highlighted the EU’s own protectionist framework. The EU follows a Seasonal Entry Price System (EPS) for apples, with tariffs ranging between 4.8 per cent and 6.4 per cent depending on the season. Duty elimination in the EU itself takes five to seven years. “Seen in this context, India’s phased and price-protected offer is balanced,” an official said.

For New Zealand apples, safeguards are even tighter. Under the India-New Zealand FTA, concessional tariffs apply only within a quota of 32,500 MT, expanding to 45,000 MT over six years. Imports beyond this quota will face the full 50 per cent customs duty.

A higher MIP of USD 1.25 per kg (around ₹112/kg) has also been fixed, pushing post-duty prices close to ₹140 per kg. Officials said this ensures that only premium apples enter the Indian market.

Concessional imports from New Zealand will also be limited to a seasonal window from April 1 to August 31. Growers, however, have flagged concern that this window overlaps with the domestic harvest, particularly in the Shimla apple belt, where arrivals begin in July and peak in September-October. Farmers are demanding that imports be restricted strictly to April-June.

A key component of the New Zealand FTA is the Agriculture Productivity Partnership, under which Centres of Excellence for apples will be set up in India. These centres will focus on orchard management, pest and disease control, post-harvest handling and climate-resilient practices.

Officials said the aim is to raise domestic productivity and reduce import dependence, linking the initiative to the Atmanirbhar Bharat vision.

Growers have also flagged the absence of detailed operational notifications, including quota allocation, monitoring and enforcement mechanisms. Officials assured that all such notifications will be issued before the FTAs come into force and that there would be “no ambiguity” in implementation.

Export data, officials said, offers limited consolation. India exported 32,874 tonnes of apples in 2024, mainly to Bangladesh, Nepal and Bhutan. While volumes remain modest, officials believe productivity gains could expand exports over time.

Despite official assurances, apple growers remain wary. They argue that MIP alone cannot address deeper structural issues facing Indian apple farming and fear that even “controlled” imports will continue to erode already thinning profit margins unless backed by stronger domestic support policies.

#AppleFarmersAtRisk

#MIPOnPaper

#FTAImpact

#SaveIndianApples

#HimalayanGrowers