The political storm is brewing up over the India–US Trade Deal. It has Triggered Deep Farmer Anxiety. Small Holdings, Apples and Textiles in the Eye of the Storm as BJP and Congress have locked horns over the deal, that is yet to finally signed.

New Delhi/Shimla:

The proposed India–United States trade deal has snowballed into a major national controversy, with farmers’ organisations, hill-state growers and textile-linked agrarian communities voicing deep unease over what they see as a deal negotiated in haste, without publicly defined safeguards for India’s predominantly small and marginal farmers.

While the Modi government has projected the agreement as a gateway to new export markets and higher farm incomes, critics argue that assurances without transparent, enforceable protection mechanisms risk exposing Indian agriculture to highly subsidised, mechanised American farming systems—something India’s fragmented farm structure is ill-equipped to withstand.

At the heart of the debate lies a stark structural reality: over 86% of Indian farmers cultivate less than two hectares of land, operate with limited capital, face climate volatility and often sell without assured price support.

For them, even marginal price suppression caused by cheaper imports can mean the difference between survival and distress.

Government Assurances, Farmer Doubts

Union Commerce and Industry Minister Piyush Goyal has repeatedly asserted that farmers’ interests are “fully secured”, claiming the deal will help Indian products—basmati rice, fruits, spices, marine products and cotton textiles—find new markets, thereby increasing demand and prices at home.

The government has also insisted that dairy and poultry sectors remain untouched, and that sensitive crops such as rice, maize, soyabean, fruits and apples have been safeguarded.

Agriculture Minister Shivraj Singh Chouhan has echoed this position, saying every decision under the agreement has been taken with farmers’ welfare in mind.

However, farmer groups argue that political assurances are not a substitute for legally defined safeguards, especially when dealing with a partner whose agricultural sector is backed by massive subsidies, technology and scale.

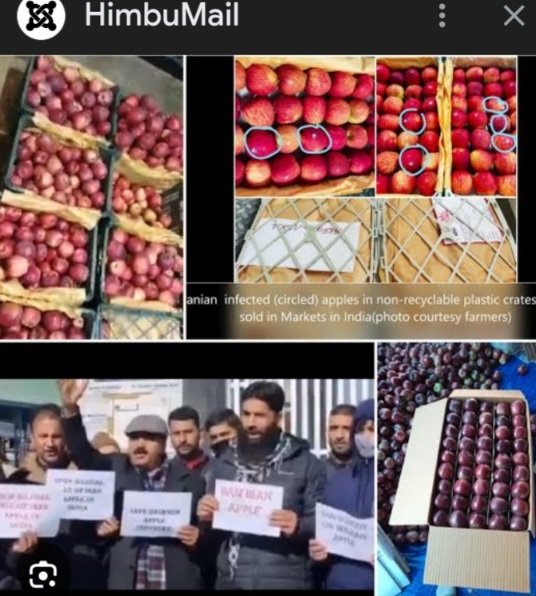

Apple Growers Fear a Repeat of Past Shocks

The anxiety is most visible in hill states such as Himachal Pradesh , Jammu and Kashmir and Uttarakhand, where apple cultivation sustains lakhs of families and forms the backbone of rural economies.

Apple growers point out that horticulture is uniquely vulnerable: fruit is perishable, markets are seasonal, and price crashes occur quickly.

Growers fear that even limited tariff relaxations—or future concessions hidden in annexures—could allow cheaper imported apples to enter the Indian market during peak domestic seasons, depressing prices at the farm gate.

What farmers are demanding is clarity on Minimum Import Price (MIP)—a safeguard that would ensure imported apples enter India only at prices significantly higher than the domestic average, preventing dumping.

“Unless MIP is clearly notified, indexed to Indian cost of production, and reviewed annually, ‘protection’ remains only a word,” a senior apple grower said, adding that previous experiences with fluctuating import duties have already hurt orchardists.

Small Farmers vs Mechanised Agriculture

Leader of Opposition Rahul Gandhi has framed the issue as an existential challenge, warning that the deal opens Indian agriculture to competition from large, mechanised American farms running into thousands of acres, heavily subsidised and technologically advanced.

His central argument resonates with farmer unions: Indian farmers operate on small plots, with limited mechanisation and rising input costs, while US farm products often reflect state-backed pricing advantages, not free-market efficiency.

Farmers worry that once import gates are opened—even partially—price pressure becomes permanent, while relief mechanisms arrive late, if at all.

Cotton and Textiles: A Linked Crisis

The unease is not limited to food crops. The cotton–textile value chain, which supports millions of farmers and workers, is also under strain.

While the government argues that higher textile exports will increase demand for cotton, critics question whether Indian textiles will remain competitive if rival exporters enjoy lower US tariffs.

Cotton growers fear a scenario where:

-

Textile units lose export competitiveness,

-

Domestic cotton demand weakens,

-

Farm-gate prices stagnate or fall—despite higher global trade volumes.

Without tariff parity, export incentives and logistics support, farmers argue that benefits may accrue to large exporters rather than producers.

Safeguards Farmers Want Spelt Out

Across regions, farmers are raising a common demand: put the protections in black and white. Among the key safeguards they want clearly defined and notified are:

-

Minimum Import Price (MIP) for apples and other sensitive fruits, set above domestic prices and indexed to Indian cost structures

-

Automatic safeguard triggers allowing tariffs to rise if imports surge beyond defined thresholds

-

Time-bound quotas, not open-ended access

-

Crop-wise impact assessments, made public before implementation

-

Assurance that MSP and procurement regimes remain insulated from trade pressures

Farmer leaders argue that without these, India risks repeating the mistakes of earlier liberalisation phases, where market shocks were socialised among farmers while gains accrued elsewhere.

Trust Deficit Looms Large

Prime Minister Narendra Modi has consistently maintained that his government is committed to farmer welfare. Yet, analysts say the intensity of the backlash reflects a deep trust deficit, shaped by memories of the repealed farm laws and a broader fear of corporate and foreign dominance in agriculture.

Experts warn that trade deals touching agriculture cannot rely on broad political messaging alone. They require granular transparency, legally enforceable safeguards and continuous monitoring.

Until the government publicly releases detailed sector-wise protections—especially on MIP for fruits, tariff ceilings and emergency safeguards—the India–US trade deal is likely to remain a flashpoint, with farmers across regions watching anxiously, uncertain whether the promise of global markets will translate into prosperity or precarity at home.