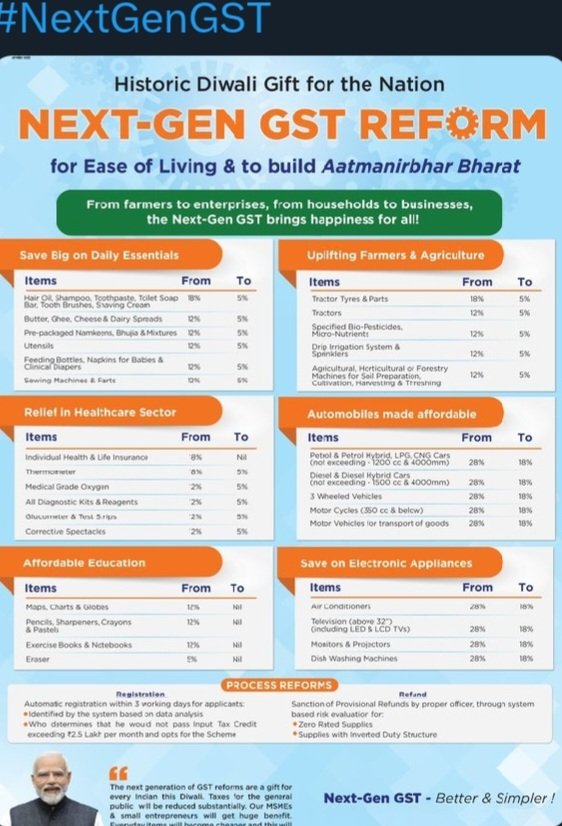

GST Cuts Across India: Students, Farmers, and Families Get Major Relief Ahead of Bihar Polls. New GST Rates will come into force from September 22.

New Delhi, Sept 4:

India’s Council has announced sweeping GST rate reductions across automobiles, services, insurance, agriculture, and essentials.

The cuts, fulfilling PM Narendra Modi’s Independence Day promise, are expected to ease household budgets, boost consumption, and stimulate the economy ahead of the Bihar assembly elections.

Finance Minister Nirmala Sitharaman said at a press briefing in New Delhi:

“These GST cuts are not just about cheaper goods. They are about empowering families, students, farmers, and MSMEs.

Relief in mobility, services, and essentials will directly improve lives in towns, villages, and urban households.

This will also strengthen economic growth and job creation across sectors, say experts.

In Automobiles, it means an Affordable Mobility for Students and Families.

The automobile sector, supporting 3.5 crore jobs, gets major relief:

Two-wheelers (≤350cc): Cheaper bikes make it easier for students, gig workers, and rural youth to commute and reduce EMI burdens.

Small cars (<1200cc petrol, <1500cc diesel, ≤4m length): Families and first-time buyers in small towns benefit from affordable car ownership.

Large cars: Flat 40% GST (no cess) simplifies taxation and reduces costs for urban aspirational buyers.

Buses (10+ seaters): Reduced GST helps schools, colleges, and commuters with affordable transport.

Commercial trucks & delivery vans: Cheaper logistics lowers transport costs for goods and essentials.

Tractors & tractor parts: Lower costs boost farm incomes and mechanisation.

Auto components: Reduced rates strengthen MSMEs and Make in India initiatives.

Services – Relief for Students and Households

Transport of goods & passengers by road: Choice of 5% or 18% GST.

Hotel stays (≤₹1000/day): GST exempted for students and exam travelers.

Cinema tickets (<₹100): Reduced to 12%, making entertainment affordable.

Laundry & tailoring services: 5% GST.

Third-party truck insurance: 12% → 5% with ITC, reducing business and logistics costs.

Essentials & Insurance – More Money for Education

Food staples (atta, rice, curd): Exempted from GST.

Sanitary napkins: Fully exempted.

LED bulbs & appliances: 12% → 5%.

Health & term insurance: 18% → 12%.

Agri implements (pumps, sprinklers, farm tools): 12% → 5%.

Families save on living costs, freeing money for education and coaching.

Economic Impact & Make in India Boost

Experts say GST cuts will stimulate consumption, create jobs, and boost MSMEs. Lower costs for vehicles, trucks, and services support exports and strengthen India’s Make in India agenda.

SCO Summit Outcome – Global Spotlight

The recently concluded SCO summit in China saw PM Modi meet Xi Jinping and Vladimir Putin.

Indian media highlighted India’s strengthened strategic and economic position.

US media interpreted the summit as India asserting autonomy, using domestic reforms like GST to counter global trade pressures mainly from cheap Chinese goods.

GST cuts signal India’s focus on internal growth, resilient demand, and reduced dependence on volatile global markets.

Who Gains Most?

Students: Affordable mobility, hostels, exams, and entertainment.

Youth & gig workers: Cheaper bikes, cars, and EMIs.

Farmers: Cost-efficient tractors and implements boost incomes.

Women: Sanitary napkin exemption and lower household costs.

Families: Savings on food, transport, insurance, and energy redirected to education.

GST Rates at a Glance

Item / Service Old GST Rate New GST Rate

Two-wheelers (≤350cc) 28% 18%

Small cars (<1200cc petrol / <1500cc diesel, ≤4m) 28% 18%

Large cars 28% + cess Flat 40%, no cess

Buses (10+ seaters) 28% 18%

Commercial trucks & delivery vans 28% 18%

Tractors (<1800cc) 12% 5%

Road tractors (>1800cc) 28% 18%

Tractor parts 12% 5%

Auto components 28% / 18% 18%

Hotel stays (≤₹1000/day) 12% Exempted

Cinema tickets (<₹100) 18% 12%

Laundry & tailoring 12% 5%

Third-party truck insurance 12% 5% (with ITC)

Food staples (atta, rice, curd) 5% Exempted

Sanitary napkins 12% Exempted

LED bulbs & appliances 12% 5%

Health & term insurance 18% 12%

Agri implements 12% 5%