Chandigarh/Shimla:

IDFC First Bank has officially admitted financial discrepancies of around ₹590 crore in government-linked accounts in Chandigarh Branch.

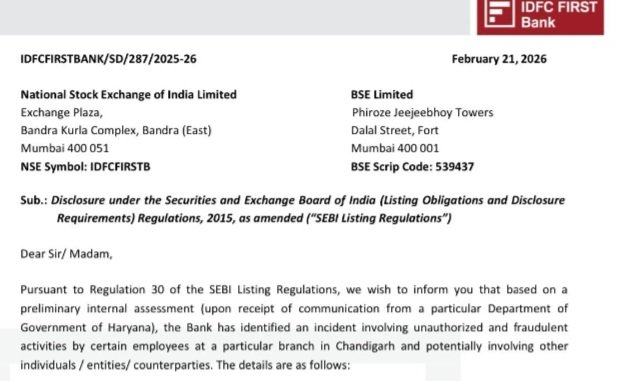

In a regulatory disclosure submitted to the National Stock Exchange of India and the BSE Limited under the SEBI Listing Regulations, the bank acknowledged that a preliminary internal assessment revealed serious lapses following a communication from a department of the Government of Haryana.

The Haryana government department had sought closure of its account and transfer of funds to another bank, during which discrepancies were detected between the balances available in the account and the amounts claimed.

From February 18, 2026 onwards, similar mismatches were observed in accounts of other Haryana government entities maintained with the bank.

The bank has stated that the irregularities—described by depositors as a major banking scam—are presently confined to a specific set of government-linked accounts operated through the Chandigarh branch and do not involve other customers, according to its internal review.

“The aggregate amount under reconciliation across the identified accounts is approximately ₹590 crore,” the bank said, adding that the eventual financial impact would depend on further verification, recoveries, identification of fraudulent beneficiary accounts maintained with other banks, and the legal recovery process.

The admission has triggered concern among depositors in Himachal Pradesh, as the bank also operates its branch in Shimla, raising a big question mark over its credibility and internal control mechanisms, depositors said while seeking assurances on the safety of their deposits.

As part of immediate action, the bank has suspended four officials pending investigation and has initiated steps to pursue disciplinary, civil, and criminal proceedings against employees and external entities found responsible.

The bank said the matter remains under investigation and further disclosures will be made as required under regulatory norms.