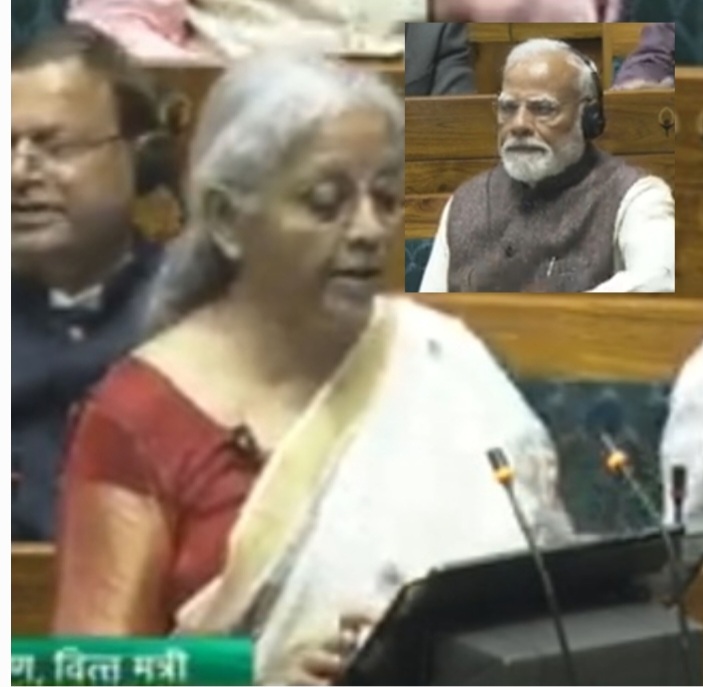

New Delhi: Union Finance Minister Nirmala Sitharaman, in what seems like a direct pitch to the middle class ahead of the Delhi assembly elections, has played the tax card—raising the nil-tax slab to ₹12 lakh and tweaking the slabs under the new regime.

While the move is being projected as a major relief to taxpayers, a deeper look reveals a more strategic electoral calculation than an economic masterstroke.

Middle-Class Focus or Vote-Bank Politics?

The budget speech was laced with praise for the middle class, calling them the backbone of India’s growth. But why this sudden generosity?

The BJP is facing a tough electoral battle in Delhi, and with an eye on urban voters, this tax rejig seems more like a calculated poll move than a genuine structural reform.

For years, salaried taxpayers have been burdened with high taxes while corporate tax rates have been slashed. This time, Sitharaman announced a substantial tax relief—raising the nil-tax slab from ₹7 lakh to ₹12 lakh, effectively exempting a large chunk of earners.

But there’s a catch: this benefit is available only under the new tax regime, which does not allow deductions for savings, insurance, or home loans.

The government’s long-term push is to phase out the old tax regime and force taxpayers into a system that reduces exemptions, ultimately discouraging long-term financial planning.

What Do the New Tax Slabs Mean?

The revised tax slabs are as follows:

- ₹0 - ₹4 lakh: Nil

- ₹4 - ₹8 lakh: 5%

- ₹8 - ₹12 lakh: 10%

- ₹12 - ₹16 lakh: 15%

- ₹16 - ₹20 lakh: 20%

- ₹20 - ₹24 lakh: 25%

- Above ₹24 lakh: 30%

At first glance, this looks like a huge tax relief, but let’s break it down:

- Someone earning ₹12 lakh will pay zero tax under the new regime. Sounds great, right? But if they were using deductions under the old regime—investing in PPF, home loan EMIs, medical insurance, and NPS—their taxable income would have already been significantly lower, reducing their tax liability.

- A taxpayer earning ₹18 lakh saves ₹70,000, but this is still less than what they might have saved with exemptions in the old regime.

- High earners (₹25 lakh+) get a modest cut, meaning the government is not really aiming for relief to the upper middle class.

Tax Cut vs. Revenue Loss: Who Pays the Price?

The government claims it will forego ₹1 lakh crore in direct taxes and ₹2,600 crore in indirect taxes due to these changes. Where will this shortfall be recovered from?

The answer is obvious: higher GST, indirect taxes, and disinvestment of PSUs.

The tax relief for the middle class could mean a hike in fuel taxes, GST on essential goods, and reduced public spending on social sectors like health and education.

The Elephant in the Room: Unemployment and Inflation

Tax relief is always welcome, but will it create jobs? Will it control inflation? The budget has no concrete roadmap for job creation, leaving lakhs of unemployed youth in a lurch.

While the government talks about a "Viksit Bharat" by 2047, it has failed to address rising layoffs in the IT sector, stagnating rural wages, and the increasing gig economy crisis, said critics.

The middle class is already battling high food inflation, expensive housing, and rising medical costs—a few thousand rupees saved in taxes won’t offset these burdens, commented tax payers.

Who Wins, Who Loses?

✔ Winners:

- The urban middle class, especially those in metros who were stuck in the ₹7–12 lakh tax trap.

- The government, which now has a strong election pitch for Delhi, Maharashtra, and urban constituencies in 2026.

❌ Losers:

- The farmers whose assets are the land resources mainly in hard mountain states like Himachal, Uttarakhand who are migrating to cities in search of jobs, remain stagnant.

- No incentives and Nautore land for farmers to sustain on horticulture which has become unviable due to paucity of land, crops failures and climate change and disasters. The lower middle class, who will see no relief in GST or essential goods prices.

- Those preferring the old tax regime, as deductions will soon be phased out, forcing them into a system that discourages savings.

- The salaried class, which still faces high professional tax, limited social security, and stagnant real wage growth.

Final Verdict: Populist Sugarcoating

While the tax relief looks like a big win, the real beneficiaries are limited, and the bigger economic concerns—sustainable agriculture and horticulture, jobs, inflation, and fiscal stability—remain unaddressed.

The Modi government has made a strategic populist move, but whether it translates into actual economic relief for the middle class or remains just an election gimmick—only time will tell.

In the Union Budget 2025-26, Finance Minister Nirmala Sitharaman announced several initiatives aimed at bolstering the agriculture sector and supporting farmers:

1. Launch of 'PM Dhan Dhanya Krishi Yojana': This new scheme targets 100 districts identified for low agricultural productivity, moderate crop intensity, and below-average credit access.

The program aims to enhance crop yields and improve credit access, benefiting over 10 million farmers nationwide.

2. Continued Support for Rural Employment: The government has allocated ₹860 billion for the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) for the fiscal year 2025-26, maintaining the previous year's funding level.

This initiative ensures a minimum wage for rural citizens for at least 100 days annually through various infrastructure projects.

3. Focus on Agriculture, MSMEs, and Exports: The budget emphasizes the importance of agriculture, Micro, Small, and Medium Enterprises (MSMEs), and exports as key areas for economic growth.

These measures reflect the government's commitment to strengthening the agricultural sector, improving farmers' livelihoods, and promoting inclusive economic development, she claims.

Key Tax & Investment Proposals

The government is expanding Safe Harbour Rules to reduce litigation and ensure tax certainty in international taxation. Senior citizens holding old National Savings Schemes (NSS) accounts will now be exempt from tax on withdrawals made on or after August 29, 2024. Similar exemptions will apply to NPS Vatsalya accounts, subject to existing limits.

Tax processes, including appellate orders, are now fully digitized. The Vivaad Se Vishwas scheme, launched in July 2024, has seen 33,000 taxpayers settle disputes.

To boost investment and jobs, a presumptive taxation regime is being introduced for non-residents providing services to electronics manufacturers. Safe harbour provisions will apply to non-residents storing components for these units. The Tonnage Tax Scheme will now extend to inland vessels under the Indian Vessels Act, 2021, promoting water transport.

The startup incorporation period has been extended by five years (till 2030) for tax benefits. IFSC incentives are being expanded for ship leasing units, insurance offices, and treasury centres of global firms, with the commencement deadline extended to 2030.

To encourage infrastructure funding, taxation certainty is proposed for Category 1 & 2 AIFs, while sovereign wealth funds and pension funds can now invest in infrastructure with benefits extended until March 31, 2030.

Budget 2024: Major Tax and Trade Reforms Announced

Finance Minister announced key reforms in customs and direct taxes to boost trade, ease compliance, and support the middle class.

Customs & Trade Reforms

- Leather Sector: Full exemption of BCD on wet blue leather and removal of 20% export duty on crust leather to support small tanners.

- Marine Industry: Reduction of BCD on fish paste surimi (30% to 5%) and fish hydrolyze (15% to 5%) to enhance exports.

- Aircraft & Ships: Export time limit for repaired foreign-origin goods extended from 6 months to 1 year, further extendable by another year, now applicable to railway goods as well.

- Ease of Doing Business: Provisional customs assessments must now be finalized within two years, extendable by one year, reducing uncertainty.

- Voluntary Compliance: Importers/exporters can voluntarily declare facts post-clearance, pay duty with interest, and avoid penalties—except in cases under audit/investigation.

- Import Rules: Time for utilizing imported inputs extended from 6 months to 1 year for greater operational flexibility. Quarterly filing replaces monthly statements.

Direct Tax Reforms

- TDS/TCS Rationalization:

- Fewer TDS rates and thresholds for easier compliance.

- Senior citizens: Tax-free interest limit doubled from ₹50,000 to ₹1 lakh.

- Rental TDS threshold increased from ₹2.4 lakh to ₹6 lakh.

- LRS remittances: TCS exemption for education loans, threshold raised from ₹7 lakh to ₹10 lakh.

- Updated Income Tax Returns: Filing window extended from 2 years to 4 years for voluntary disclosures.

- Charitable Trusts: Registration period increased from 5 years to 10 years to reduce compliance burden.

- Housing Relief: Taxpayers can now claim two self-occupied properties as tax-free without restrictions.

- Transfer Pricing: Introduction of a block pricing mechanism for international transactions to streamline compliance.

These reforms, guided by PM Modi’s vision of Sabka Saath, Sabka Vikas, aim to simplify taxation, promote investment, and boost economic growth.

Key Highlights of Budget 2025: Regulatory Reforms, Fiscal Discipline, and Tax Cuts

Finance Minister rolled out a bold set of reforms aimed at simplifying regulations, boosting domestic manufacturing, and maintaining fiscal discipline. Here are the top takeaways:

Regulatory Overhaul & Ease of Business

- A High-Level Committee for Regulatory Reforms will review all non-financial sector regulations, licenses, and permissions, with recommendations due in a year.

- Investment Friendliness Index for states to be launched in 2025 to encourage competitive federalism.

- Jan Vishwas Bill 2.0 to decriminalize 100+ legal provisions, continuing the reform path of the 2023 Act.

Fiscal Policy & Deficit Control

- FY 2024-25 revised estimates:

- Total receipts (excluding borrowings): ₹31.47 lakh crore

- Total expenditure: ₹47.16 lakh crore

- Fiscal deficit: 4.8% of GDP

- FY 2025-26 estimates:

- Total receipts: ₹34.96 lakh crore

- Total expenditure: ₹50.65 lakh crore

- Fiscal deficit: 4.4% of GDP

- Net market borrowings: ₹11.54 lakh crore

Indirect Tax Reforms

Customs Tariff Simplification

- 7 more tariff rates removed, reducing total to just 8.

- Social welfare surcharge exempted on 82 tariff lines.

Healthcare Relief

- 36 life-saving drugs fully exempted from basic customs duty.

- 37 new medicines added under patient assistance programs.

Boost for Manufacturing & MSMEs

- Full exemption on 12 more critical minerals for EVs and tech sectors.

- Technical textiles: Two more shuttle-less looms exempted.

- Electronics:

- LCD/LED open cell parts duty slashed to zero.

- Flat panel displays duty hiked from 10% to 20%.

- EV Batteries & Mobile Phones:

- 35 capital goods exempted for EV battery production.

- 28 capital goods exempted for mobile phone battery manufacturing.

Shipping & Telecom Sector Boost

- Shipbuilding raw material duty exemptions extended for 10 years.

- Carrier-grade Ethernet switch duty cut from 20% to 10%.

With a focus on trust-based governance, fiscal prudence, and a pro-business tax regime, this budget signals a shift towards long-term economic resilience.

Govt to Ease Business, Credit, and Investment Norms

The government is set to roll out key reforms in 2025 to boost business and credit access. Banks will develop a Brahmin Credit Score Framework to cater to rural and SNG members' financial needs. A regulatory forum will be established for better coordination and product development.

The Central KYC Registry will be revamped, and procedures for company mergers will be simplified, expanding the scope for fast-track approvals. The Model BIT will also be revamped to attract more foreign investment.

With a light-touch, trust-based regulatory approach, the government aims to align policies with tech innovations and global standards, driving productivity and employment.