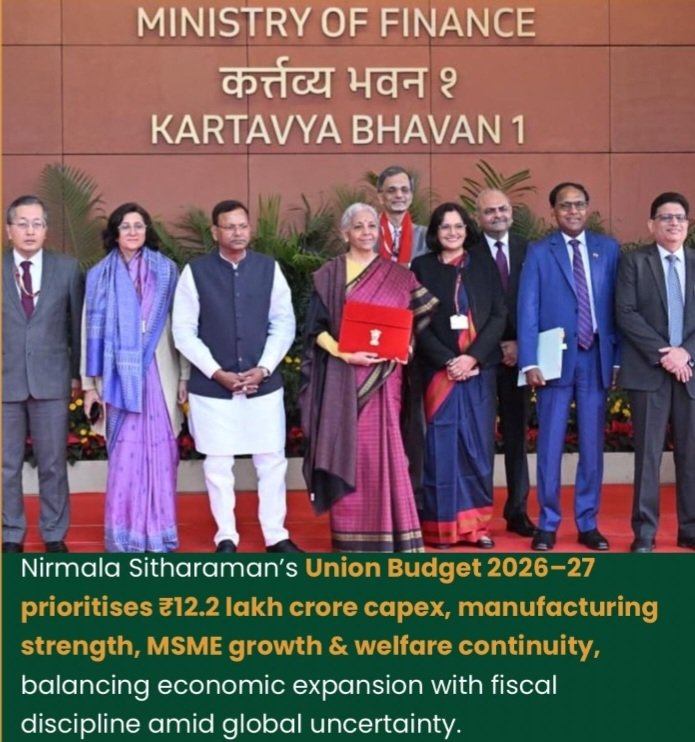

New Delhi/Shimla: The Union Budget 2026-27 has brought no change in income-tax slabs for individual taxpayers, offering stability but limited relief to the salaried class and pensioners already grappling with rising living and medical costs.

Tax experts said the absence of major tax relief is also linked to the fact that 2026-27 is not an election year.

According to them, Finance Minister Nirmala Sitharaman has chosen to maintain fiscal discipline rather than use tax cuts to woo the middle class. “In non-election years, governments usually avoid populist tax giveaways.

The salaried class may see meaningful relief next year, possibly through a combination of new pay scale revisions and tax concessions,” an expert said, adding that expectations of a middle-class windfall are now being pushed to the next Budget cycle.

Finance Minister Nirmala Sitharaman announced that both the new and old tax regimes will continue unchanged, dashing hopes of fresh tax cuts or a higher exemption limit for the middle class.

Income Tax Slabs Under New Tax Regime

Up to ₹4 lakh – Nil

₹4 lakh to ₹8 lakh – 5%

₹8 lakh to ₹12 lakh – 10%

₹12 lakh to ₹16 lakh – 15%

₹16 lakh to ₹20 lakh – 20%

₹20 lakh to ₹24 lakh – 25%

Above ₹24 lakh – 30%

With a standard deduction of ₹75,000 and rebate under Section 87A, salaried taxpayers earning up to about ₹12.75 lakh annually will continue to pay zero income tax under the new regime. However, this relief remains the same as last year, with no enhancement announced.

What Pensioners Get

Pensioners will also see no additional concessions in this Budget.

Senior citizens can continue to claim higher basic exemption limits under the old tax regime.

No special increase has been made in deductions for medical expenses or pension income.

Many retirees say the unchanged tax structure offers little comfort as healthcare costs continue to rise sharply.

Middle Class Reaction

Salaried employees and pensioners said the Budget provides predictability but no real relief.

“Our income is fixed, but expenses like education, medicines and EMIs are rising every year. Some additional tax relief would have helped,” said a government employee.

Tax experts note that the new tax regime has become the default option for most salaried taxpayers with fewer deductions, while those with home loans and investments may still prefer the old regime.

Budget 2026-27 focuses on fiscal stability rather than tax concessions, leaving the salaried class and pensioners to manage with the same tax slabs and limited relief.

#Budget2026 #IncomeTaxSlabs #TaxRelief #SalariedClass #Pensioners #MiddleClass #UnionBudget #PersonalFinance #IndiaEconomy #TaxNews